43 the formula for depreciable cost is

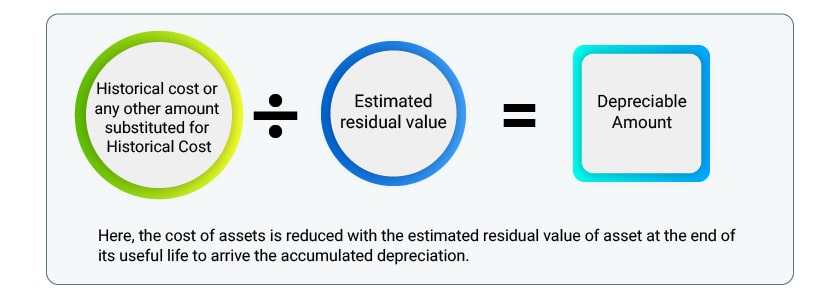

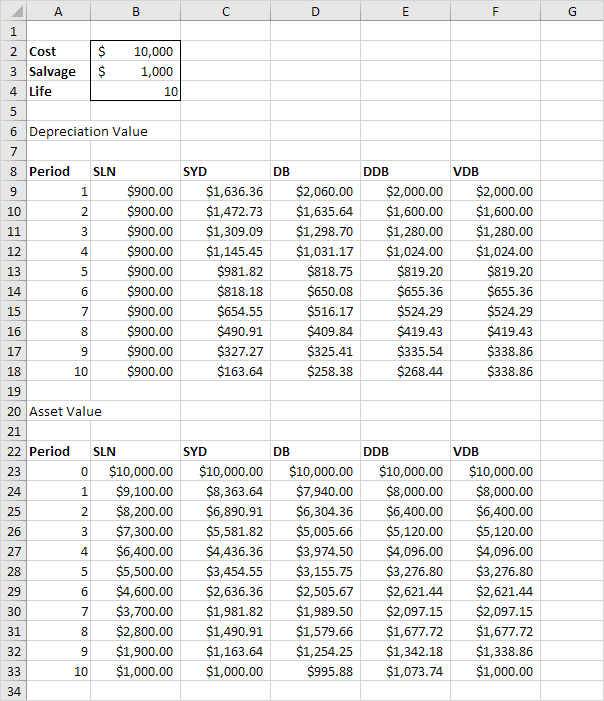

Depreciated Cost - Overview, How To Calculate ... Thus, at the end of 2019, the accumulated depreciation is $14,250 ($4,750 * 3), and the depreciated cost is $95,750 ($110,000 - $14,250). At the end of the useful life of the asset, the accumulated depreciation will be $95,000 ($4,750 * 20). The depreciated cost will be $15,000 ($110,000 - $95,000), equal to the salvage value . What is Depreciable Value? (Explanation and Example ... ABC Co. uses the following formula for depreciable value. Depreciable value = Asset's cost (acquisition cost or fair value) - Asset's salvage value. Depreciable value = $200,000 - $15,000. Depreciable value = $185,000. Conclusion. Depreciation is a method companies use to allocate an asset's cost over its useful life.

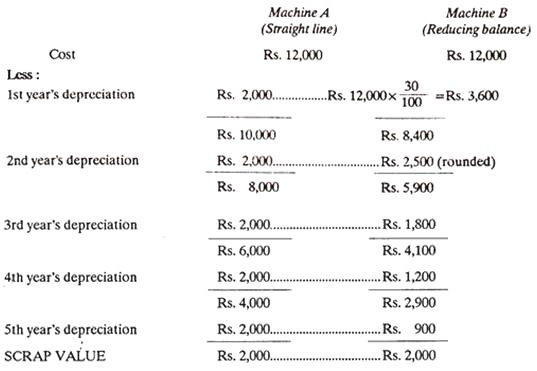

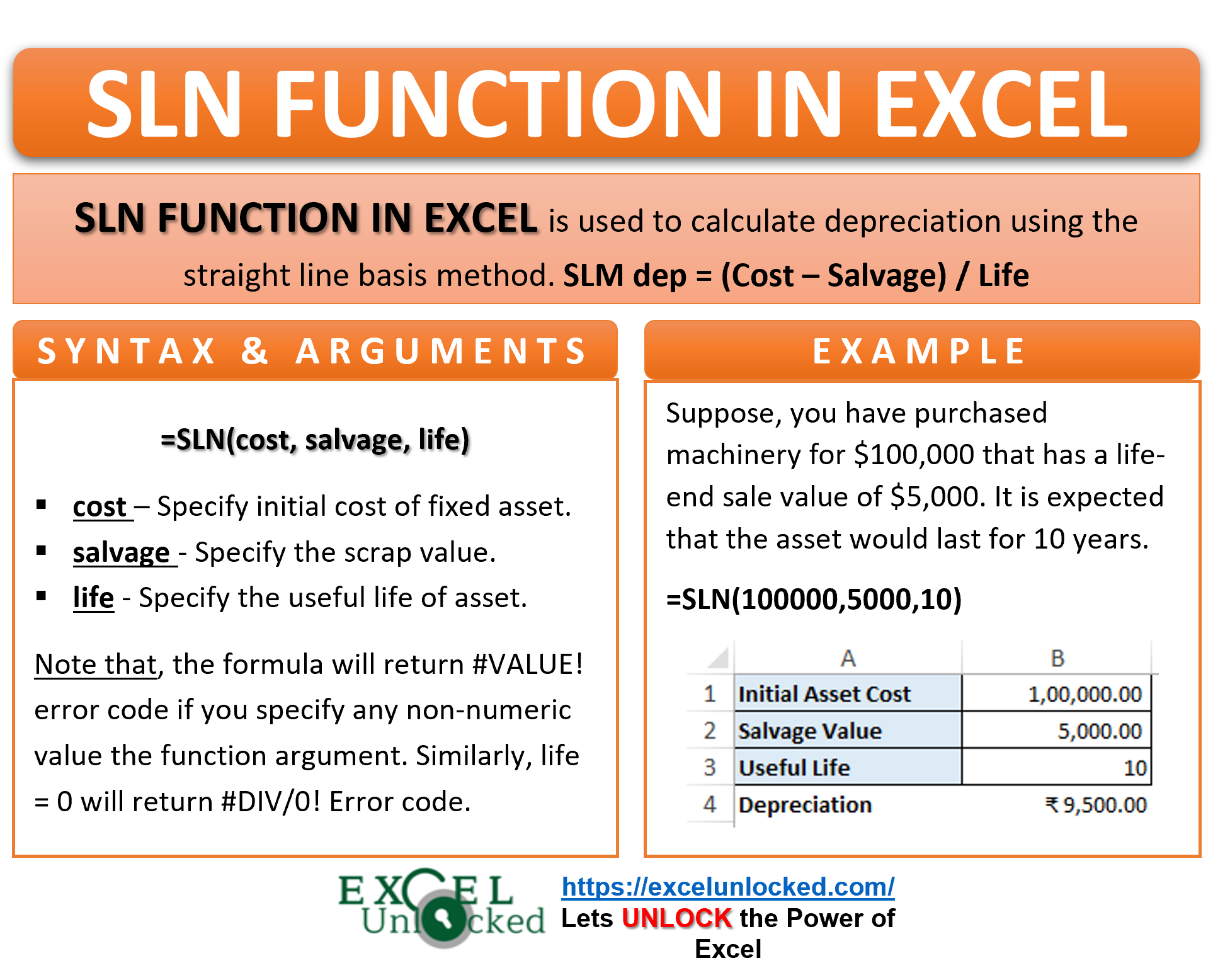

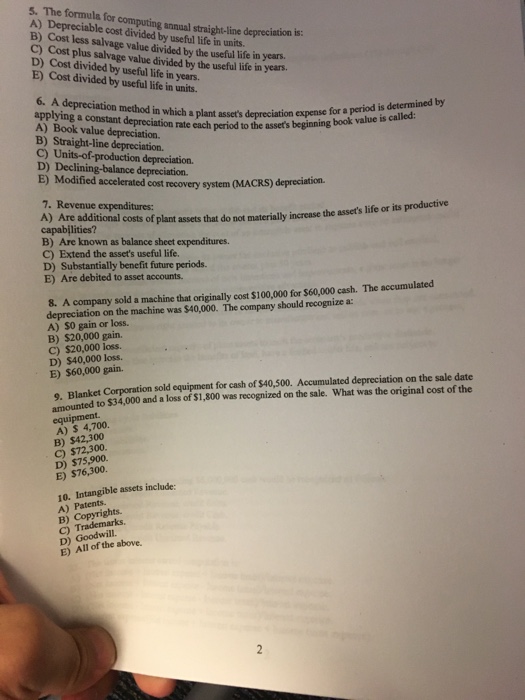

Solved > 91. The formula for calculating straight-line ... 91. The formula for calculating straight-line depreciation is: A. Depreciable cost divided by the useful life in years. B. Cost plus residual value divided by the useful life in years. C. Depreciable cost divided by useful life in units. D. Cost divided by useful life in years. E. Cost divided by useful life in units. 92.

The formula for depreciable cost is

How To Depreciate Assets Using The Straight | Simple ... Straight Line Depreciation Formula. Over the useful life of an asset, the value of an asset should depreciate to its salvage value. It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. This is very important because we need to calculate depreciable values or amounts. Revised Depreciation | Calculation | Journal Entry ... The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the revision date from the original cost of the fixed asset. And then divide the remaining depreciable cost with the remaining useful life to determine the revised ... Self employed Business, Professional, Commission ... - Canada Since land is not depreciable property, he has to calculate the part of the expenses connected with the purchase that relates only to the building. To do this, he has to use the following formula, explained under the heading Land. $75,000 ÷ $90,000 × $5,000 = $4,166.67

The formula for depreciable cost is. Formula for depreciable cost? - Answers So, depreciation on a factory building and factory equipment directly used to manufacture a product are both product costs.Conversely, depreciation on equipment that is NOTdirectly used in... (Get Answer) - The formula for depreciable cost is a ... The formula for depreciable cost is a. Initial Cost - Residual Value Ob. Initial Cost - Accumulated Depreciation Oc. Depreciable Cost = Initial Cost Od. Initial Cost + Residual Value Solved Define the following terms: | Chegg.com Depreciable Cost: Book Value: Depreciation: Residual Value: List three methods of depreciation and the basic formula to calculate corresponding "amount" in the journal entry. a. b. c. Which one of the three methods in #6 above does not subtract the "Residual Value" (also called Salvage Value) in the formula to calculate the amount of expense? What is the formula for depreciable cost? - Greedhead.net The following is the formula: Depreciation per year = Asset Cost - Salvage Value How to calculate annual depreciation expense for SLD?

Straight Line Depreciation - Formula & Guide to Calculate ... The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%. Note how the book value of the machine at the end of year 5 is the same as the salvage value. Depreciable Cost: What Does Depreciable Cost Mean? Depreciation cost = Purchase price of an asset - Cumulative depreciation Depreciation expense or depreciation costs is the amount of depreciation that is reported on the income statement. It's allocated portion of the cost of the fixed assets of a business that is appropriate for the accounting period Straight Line Depreciation: Definition, Formula, Examples ... Formula and calculation along with examples of depreciation; Journal entries for the Straight Line depreciation ; What is Depreciation? Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful life or life expectancy. Depreciation is a measure of how much of an asset's value has been depleted over the depreciation schedule or period. … Provisions relating to capital gains in case of ... 21/03/2020 · Provisions relating to capital gains in case of depreciable assets. According to section 50 of Income tax act if an assessee has sold a capital asset forming part of block of assets (building, machinery etc) on which the depreciation has been allowed under Income Tax Act, the income arising from such capital asset is treated as short term capital gain.

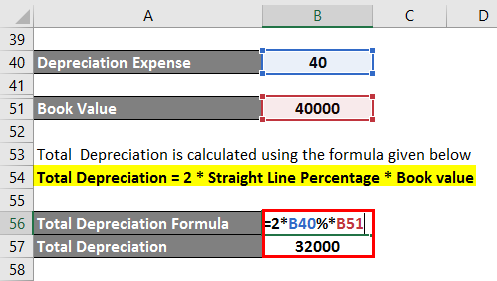

What is the formula to calculate depreciation ... Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20. How do you calculate depreciation per year? Determine the cost of the asset. Cost Segregation Audit Techniques Guide - Chapter 5 - Review ... In the case of an acquisition including a combination of depreciable and non-depreciable property for a lump sum (e.g., buildings and land), the basis for depreciation cannot exceed an amount which bears the same proportion to the lump sum as the value of the depreciable property at the time of acquisition bears to the value of the entire ... The formula to compute annual straight-line depreciation is: The formula to compute annual straight-line depreciation is: Select one: a. Depreciable cost divided by useful life in units. b. (Cost minus salvage value) divided by the useful life in years. c. (Cost plus salvage value) divided by the useful life in years. d. Cost multiplied by useful life in years. Double Declining Depreciation Calculator - [100% Free ... The Purchase Price refers to the original value of your asset or the depreciable cost. The Useful Life refers to the expected time that the asset will be productive for its expected purpose. Here are the steps for the double declining balance method: Divide 100% by the number of years in your asset’s useful life. The quotient you get is the SLD rate. Multiply the value you get by 2. This ...

Income Tax Folio S3-F4-C1, General Discussion of ... - Canada 20/11/2018 · 1.62 The undepreciated capital cost to a taxpayer of depreciable property of a prescribed class at any time is determined by a formula in subsection 13(21). The UCC is equal to the amount, if any, by which the total of the increases to the UCC of the class ( elements A to D.1 ) exceeds the total of the decreases to the UCC of the class ( elements E to K ).

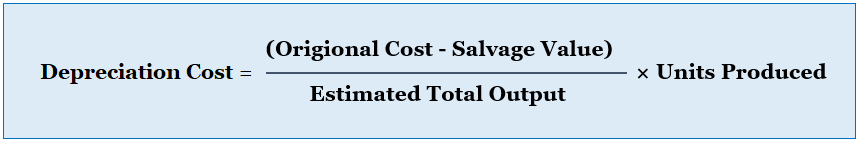

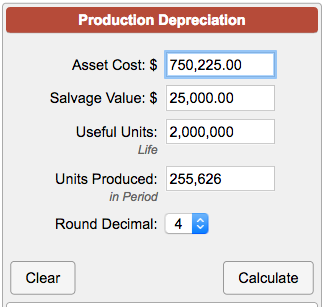

What is depreciable cost formula? - Greedhead.net Depreciation = (Asset Cost - Residual Value) / Useful Life of Asset Under the unit of production method, the formula for depreciation is expressed by dividing the difference between the asset cost and the residual value by the life-time production capacity which is then multiplied by the no. of units produced during the period.

Depreciable cost definition — AccountingTools Therefore, the depreciable cost of the machine is $8,000, which is calculated as follows: $10,000 Purchase price - $2,000 Salvage value = $8,000 Depreciable cost The company then uses a depreciation method, such as the straight-line method, to gradually charge the $8,000 depreciable cost to expense over the useful life of the machine.

Cost Segregation ATG Chapter 6 2 Change in Accounting ... A change in the treatment of an asset from non-depreciable or non-amortizable to depreciable or amortizable, or vice versa, Treas. Reg. § 1.446-1(e)(2)(ii)(d)(2); A correction to require depreciation in lieu of a deduction for the cost of depreciable or amortizable assets that had been consistently treated as an expense in the year of purchase, or vice versa, Treas. Reg. § …

What is a Depreciable Cost? - Definition | Meaning | Example Straight-line depreciation is calculated by dividing the depreciable cost by the useful life of the asset. In our plant asset example, the straight-line depreciation per year would be $9,500 ($95,000 / 10 years). This means the assets recognize $9,500 of cost per year for ten years. A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

The formula for depreciable cost is a initial cost ... The formula for depreciable cost is a initial cost residual value b initial cost | Course Hero The formula for depreciable cost is a initial cost 31.

Double-Declining Depreciation Formula • The Strategic CFO Jul 23 Back To Home Double-Declining Depreciation Formula. See Also: Double-Declining Method Depreciation. Double-Declining Depreciation Formula. To implement the double-declining depreciation formula for an Asset you need to know the asset's purchase price and its useful life.. First, Divide "100%" by the number of years in the asset's useful life, this is your straight-line ...

What is the formula for straight-line depreciation ... Example of Straight Line Depreciation Purchase cost of $60,000 - estimated salvage value of $10,000 = Depreciable asset cost of $50,000. 1 / 5-year useful life = 20% depreciation rate per year. 20% depreciation rate x $50,000 depreciable asset cost = $10,000 annual depreciation. How do you calculate straight-line depreciation mid year?

Ch 10 Quiz Flashcards | Quizlet The formula for depreciable cost is a. Initial Cost + Residual Value b. Depreciable Cost = Initial Cost c. Initial Cost - Accumulated Depreciation d. Initial Cost - Residual Value d. the units-of-activity method

ACCT CHAPTER 10 QUIZ Flashcards | Quizlet The formula for depreciable cost is a.Initial Cost - Residual Value b.Initial Cost - Accumulated Depreciation c.Depreciable Cost = Initial Cost d.Initial Cost + Residual Value. A. The natural resources of some companies include a.metal ores, copyrights, and supplies b.minerals, trademarks, and land

What Can Be Depreciated in Business? Depreciation Decoded Low-cost items with a short lifespan are recorded as business expenses. You can write off these expenses in the year they were incurred. For example, office supplies are expense items while a printer, that you would use for a longer period, is a fixed asset that depreciates every year. Which Asset Does Not Depreciate? All depreciable assets are fixed assets but not all fixed assets …

Straight Line Depreciation Formula | Calculator (Excel template) Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion. The straight Line Depreciation formula assumes that the benefit from the asset will be derived evenly over its useful life.

Depreciated Cost Definition - Investopedia Depreciated Cost = Purchase Price (or Cost Basis) − CD where: CD = Cumulative Depreciation Example of Depreciated Cost If a construction company can sell an inoperable crane for parts at a price...

EECE 450 — Engineering Economics — Formula Sheet B= initial (purchase) value or cost basis S= estimated salvage value after depreciable life dt= depreciation charge in year t N= number of years in depreciable life Book value at end of period t: BV t = B −∑ = t i di 1 Straight-Line (SL): Annual charge: dt = (B – S)/N Book value at end of period t: BV t = B − t ×d Sum-of-Years ...

Managing Cost Reimbursable Contracts - Government Training Inc Managing Cost Reimbursable Contracts Providing Guidance in Difficult Waters Management Guide & Desk Reference Compiled and Written by: Don Philpott Scott P Cook 233 Pages ISBN: 978-0-9844038-6-8 Published by Government Training Inc. Sample Table of Contents and Opening Chapter Tale of Contents Cost-reimbursement contracts..... 4 1. What is a cost …

Depreciation Formula | Calculate Depreciation Expense Straight Line Depreciation Method = (Cost of an Asset - Residual Value)/Useful life of an Asset. Diminishing Balance Method = (Cost of an Asset * Rate of Depreciation/100) Unit of Product Method = (Cost of an Asset - Salvage Value)/ Useful life in the form of Units Produced.

What is the formula to calculate depreciation ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20.

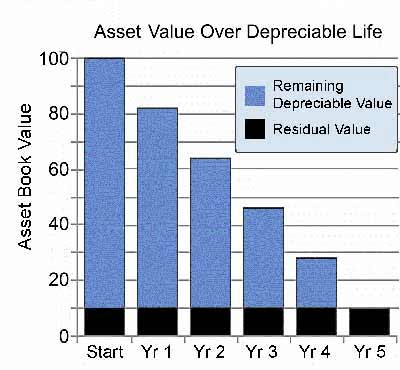

What is Depreciable Value? | Formula | Example ... Depreciable value = 50,000-5,000 = $ 45,000 Depreciation Expense = 45,000/5 = $9,000 per years At the end of the second year, company has depreciated this asset for 2 years, so the accumulated depreciation equal to 18,000 ($ 9,000 x 2 years). Asset Book value = 50,000 - 18,000 = $ 32,000

How Do I Calculate Depreciation On Residential Property ... What Is The Formula For Depreciation In Accounting? In order to calculate the straight line depreciation for the machine, the following are the costs: $100,000 for the machine. The estimated salvage value of the asset is $100,000 - $20,000, which is the total depreciable cost. The asset's useful life is five years.

4 Ways to Calculate Depreciation on Fixed Assets - wikiHow 19/04/2021 · For the second year, the depreciable cost is now $600 ($1,000 - $400 depreciation from the previous year) and the annual depreciation will be $240 ($600 x 40%). For the third year, the depreciable cost becomes $360 with a depreciation of $144, and so on.

Depreciation - Wikipedia The formula to calculate depreciation under SYD method is: SYD depreciation = depreciable base x (remaining useful life/sum of the years' digits) depreciable base = cost − salvage value Example: If an asset has original cost of $1000, a useful life of 5 years and a salvage value of $100, compute its depreciation schedule. First, determine the years' digits. Since the asset …

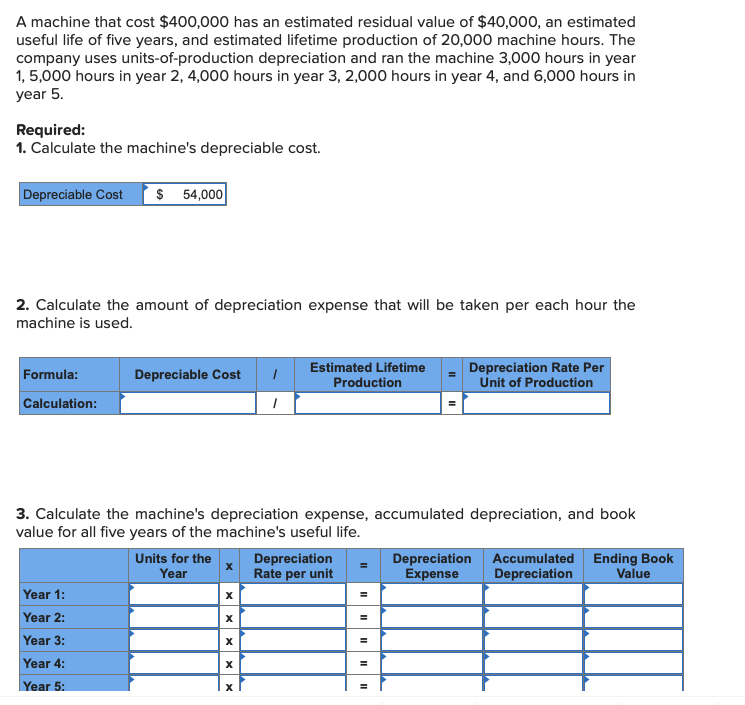

Solved 1.All of the following are needed for the ... - Chegg 2.The calculation for annual depreciation using the units-of-activity method is a. (Depreciable Cost/Yearly Output) × Estimated Output b. (Initial Cost/Estimated Output) × Actual Yearly Output c.Depreciable Cost/Yearly Output d. (Depreciable Cost/Estimated Output) × Actual Yearly Output 3.The formula for depreciable cost is

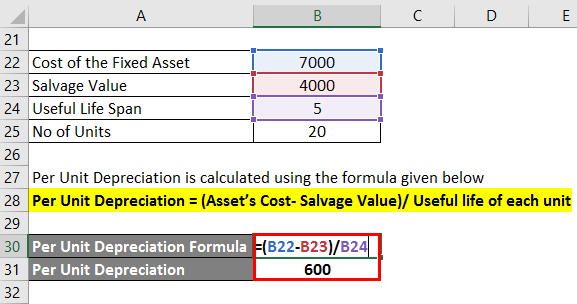

Calculate units of production depreciation | Example ... Depreciable cost per unit = Depreciable cost / Estimated units of useful life Depreciable cost can be determined by using the cost of the fixed asset deducting its estimated salvage value. Depreciable cost = Cost of fixed asset - Salvage value of fixed asset

Depreciation Schedules: A Beginner's Guide - The Blueprint 02/01/2021 · If the asset’s depreciable value is $10,000, the first year’s depreciation is $3,333 [(5/15) x 10,000]. Most of the formula stays the same in subsequent years; just reduce the numerator by one ...

Self employed Business, Professional, Commission ... - Canada Since land is not depreciable property, he has to calculate the part of the expenses connected with the purchase that relates only to the building. To do this, he has to use the following formula, explained under the heading Land. $75,000 ÷ $90,000 × $5,000 = $4,166.67

Revised Depreciation | Calculation | Journal Entry ... The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the revision date from the original cost of the fixed asset. And then divide the remaining depreciable cost with the remaining useful life to determine the revised ...

How To Depreciate Assets Using The Straight | Simple ... Straight Line Depreciation Formula. Over the useful life of an asset, the value of an asset should depreciate to its salvage value. It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. This is very important because we need to calculate depreciable values or amounts.

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

![Depreciation Schedule: Formula & Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/24192213/Depreciation-Formula-960x300.jpg)

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

0 Response to "43 the formula for depreciable cost is"

Post a Comment