42 403b vs 401k

2021 2022 401k 403b 457 IRA FSA HSA Contribution Limits Oct 13, 2021 · 2022 401k/403b/457/TSP Elective Deferral Limit. 401k/403b/457/TSP contribution limit will go up by $1,000 from $19,500 in 2021 to $20,500 in 2022. This limit usually goes up by $500 at a time but higher inflation is making it go two steps in one year. 401(k) vs. 403(b): What's the Difference and Which is ... Differences in Investment Options for 401(k) vs. 403(b) As noted above, 401(k) plan participants tend to have a larger menu of investment options than 403(b) plan consumers, who are usually ...

401a vs 401k: What's the Difference? | SoFi Feb 01, 2022 · 401(a) vs Other Retirement Plan Options 401a vs. 403b. A 403b is a tax-advantaged retirement plan offered by specific schools and nonprofits. Like 401(a) and 401(k) plans, employees can contribute with pre-tax dollars.

403b vs 401k

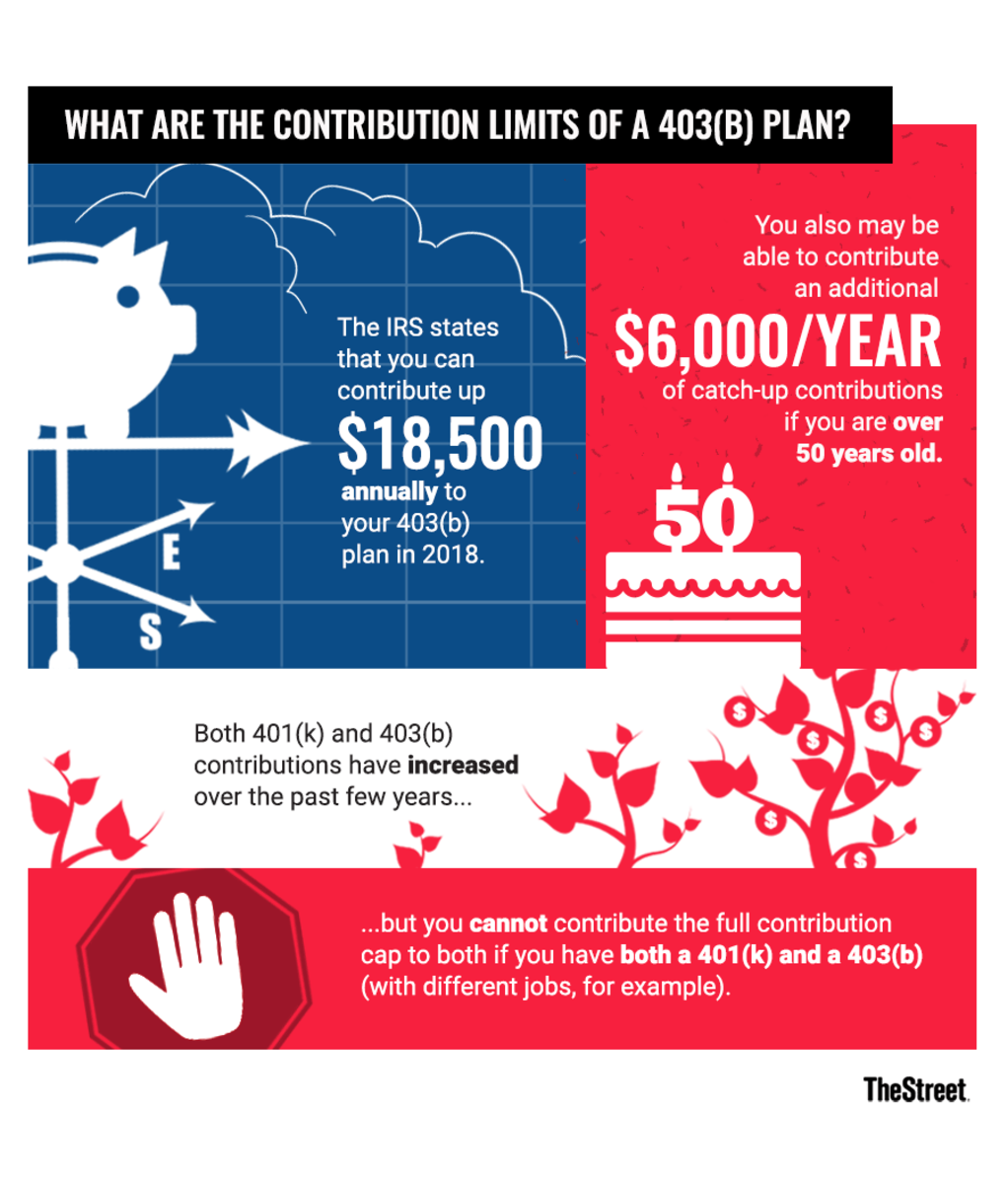

The Differences Between 401(k) and 403(b) Plans The primary difference between the two is the type of employer sponsoring the plans—401 (k) plans are offered by private, for-profit companies, whereas 403 (b) plans are only available to nonprofit... Can I Roll Over a 403(b) to an IRA or Another Account? Apr 24, 2021 · Many people change jobs multiple times over their careers, which can result in a trail of retirement accounts. Consolidating your retirement accounts can make it easier to manage and monitor your progress. When you roll over the assets in your 401(k) or 403(b) account into an IRA (Roth or traditional) or SEP (Simplified Employee Pension), your potential tax advantages … 403(b) Plan vs. 401(k) Plan: What's The Difference ... A 403b, on the other hand, can only be offered by educational institutions and tax-exempt organizations. All employees are eligible to participate, but the employers may limit their participation rules more tightly than with a 401k. This applies to both government employers and non-profits. Contribution Limits

403b vs 401k. 2022 403(b) vs. 401(k) comparison chart Feature 403(b) 401(k) Subject to ERISA Yes if considered an "employee benefit plan." Employers often limit their role and do not provide employer contributions to the plan to remain exempt from ERISA. Could also be exempt under ERISA rules (governmental or certain church plans). Yes, unless otherwise exempt (governmental or certain church ... 403(b) vs. 401(k): What's the Difference? | The Motley Fool The 401 (k) and 403 (b) are both tax-advantaged retirement accounts named after different sections of the tax code. While similar in many ways, 403 (b)s are offered only to public school employees,... 403(b) vs 401(k) - What's the Difference? How Are They the ... 401 (k) = For-profit / private companies 403 (b) = Tax-exempt organizations like public schools, hospitals, churches, etc. Are they the same thing as a "pension"? Same. Nope. Not at all. A pension is something totally different. 403(b) vs. 401(k) vs. 457(b) | John Hancock Retirement If you participate in a 401 (k) and a 403 (b), then you can only save $20,500 total between the two. If you contributed $10,000 to your 401 (k), you'd be limited to saving $10,500 in your 403 (b). That's not the case when one of the plans is a 457 (b). How do you manage all your retirement accounts?

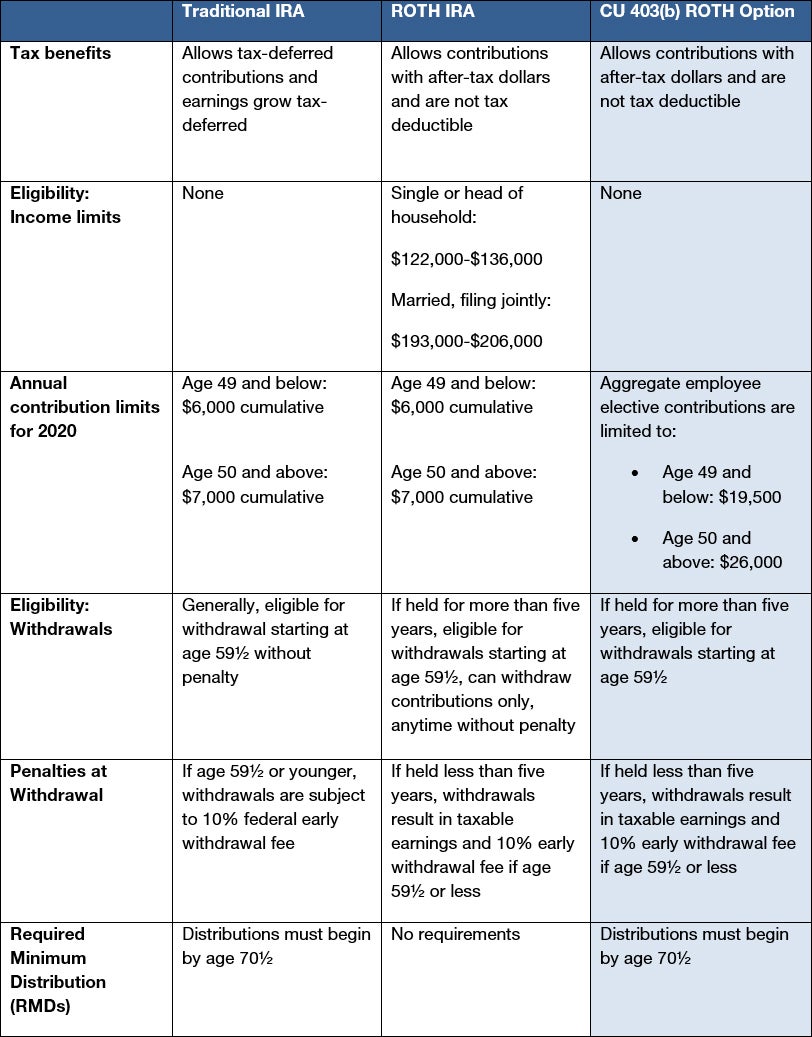

403b vs 401k: Differences and Similarities - Brandon ... The primary difference between a 403b vs 401k retirement account is who uses them. A 401k is for people employed by a for-profit organization. In contrast, the 403 (b) plan is for those who work for a non-profit organization. Some typical examples include teachers, members of religious organizations, and hospital employees. 401k Plan vs. 403(b) for a non-profit organization - 401(k ... The big difference is the universal availability rule—403 (b) plans have to cover everybody, immediately, with limited exceptions. A 401 (k) plan on the other hand can have a service requirement. The flip side of that is a 401 (k) plan is subject to the ADP test whereas a 403 (b) is not. Exactly. 403(b) vs. 401(k): What's the Difference ... 403 (b) vs. 401 (k): What's the Difference? 6 Min Read | Jan 20, 2022 Ramsey Solutions Thank you! Your guide is on its way. Invest With a Pro Who Gets This Stuff Your future is too important for guesswork. Get help from a SmartVestor Pro today. Find Your Pro Traditional vs. Roth 401(k) / 403(b) / 457(b) Calculator ... Traditional vs. Roth 401(k) / 403(b) / 457(b) Calculator This tool compares the hypothetical results of investing in a Traditional (pre-tax) and a Roth (after-tax) retirement plan. Whether you participate in a 401(k), 403(b) or 457(b) program, the information in this tool includes education to assist you in determining which option may be best ...

403(b) vs 401(k) Accounts: What's the Difference? The two most common forms of retirement accounts for employees are the 401 (k) and 403 (b). The 401 (k) retirement plan is offered mostly by for-profit companies, while the 403 (b) is used by non-profits. Occasionally, they are both offered by the same employer. Learn the key differences so that you can choose between them if you need to. 401(k) vs 403(b): Which Is the Best Choice for My Non-Profit? Typically, a 401 (k) plan is subject to this test, whereas a 403 (b) plan is not. While there are ways for 401 (k) plans to avoid this annual testing, a 403 (b) plan may offer the better opportunity for maximizing deferrals if your organization has HCEs looking to contribute. Wondering about what makes a participant an HCE, we have that info ... 403(b) vs 401(k): Complete Retirement Plans Comparison ... A 403 (b) plan is similar to a 401 (k). The major difference is a 403 (b) plan is used by non-profit companies, religious groups, school districts, and some government organizations. Most workplaces that qualify to offer a 403 (b) will not also provide a 401 (k). And for-profit corporations don't have the option of offering a 403 (b). 403(b) Plan | What Is It & How Does It Work? The biggest difference between the two is 401 (k) plans are offered by for-profit companies whereas 403 (b) plans are offered by certain government, nonprofit and religious organizations.

403b Vs. 401k: What's The Difference? | Clever Girl Finance The 401k has several similarities to the 403b: They have a $19,500 per year contribution limit in 2020, and potentially more as catch-up contributions for qualified older employees Employers often offer 401k matches as a company perk

403(b) vs. 401(k): What's the Difference? — Tally A 401 (k) can accept any type of investment, like index funds and exchange-traded funds (ETFs). A 403 (b), however, is only acceptable for mutual funds and annuities. Typically though, 403 (b)s are annuity-heavy and are administered by insurance companies, not investment firms. Also, while there are Roth 401 (k) options available, this is not ...

401k vs 403b - What's the Difference in these Retirement ... The basic difference is that a 403b is used by nonprofit companies, religious groups, school districts, and governmental organizations. The law allows these organizations to be exempt from certain administrative processes that apply to 401k plans. In other words, administrative costs for a 403b are lower.

403b vs. 401k: What's the Difference? - Good Financial Cents® 403 (b) plans are very similar to 401 (k) plans, except that where 401 (k) plans are sponsored by for-profit businesses, 403 (b) plans are for not-for-profit organizations that are tax-exempt under IRS Code 501 (c)3. That includes educational institutions, school districts, governmental organizations, religious organizations, and hospitals.

403(b) Vs. 401(k): Comparison, Pros & Cons, Examples 403 (b)s are for government or non-profit employees, while 401 (k)s are offered by for-profit companies. Alyssa Powell/Insider 403 (b) and 401 (k) plans are similar retirement savings tools offered...

401(a) vs. 403(b) | What You Need to Know - SmartAsset What's the Difference Between 401(a) and 403(b) Plans?

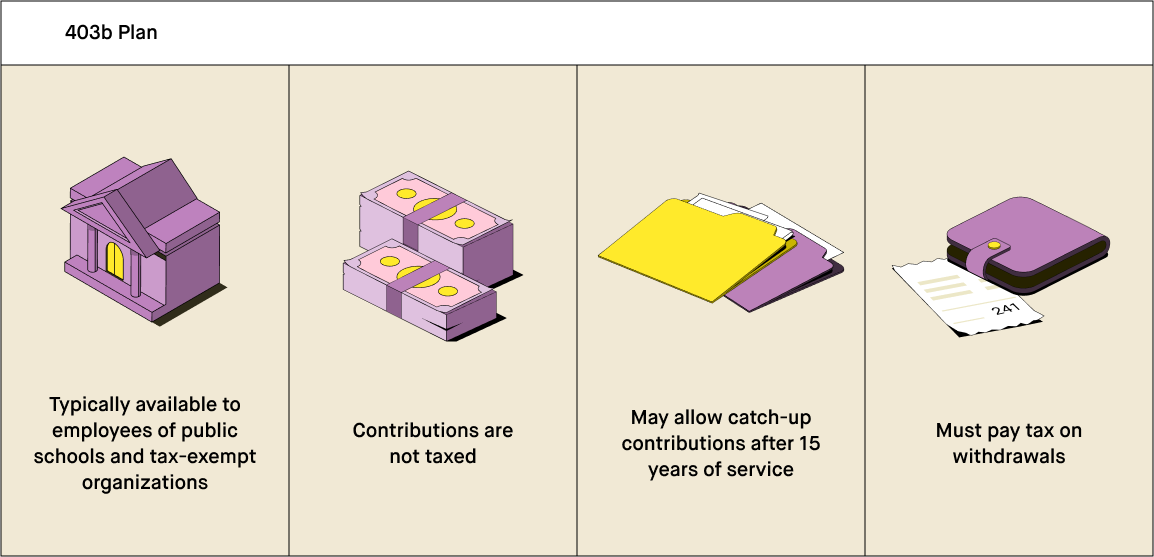

Retirement Plans FAQs regarding 403(b) Tax-Sheltered ... A 403 (b) plan, also known as a tax-sheltered annuity plan, is a retirement plan for certain employees of public schools, employees of certain Code Section 501 (c) (3) tax-exempt organizations and certain ministers. A 403 (b) plan allows employees to contribute some of their salary to the plan. The employer may also contribute to the plan for ...

403b Vs. 401k: What’s The Difference? – Forbes Advisor Dec 03, 2021 · The 403b is for non-profit and government employers, while the 401k is offered by for-profit companies. Employers offer 403(b) and 401(k) plans to help their employees save for retirement, but ...

Can You Rollover a 403b into a Traditional IRA? Absolutely! Aug 20, 2021 · I’d like to know if I should leave my 403b and 401k monies in my company’s plan when I retire later this year, or roll them over into my traditional IRA account. I have a pension with my company that was “frozen” in 2013, that has $100k in it. My monthly pension check for life without the 403b and 401k added in would only be $700, but ...

401(k) Contribution Limits for 2021 vs. 2022 - Investopedia Jan 09, 2022 · The chart below from the Society for Human Resource Management and information from the IRS provides a breakdown of how the rules and limits for defined-contribution plans (401(k), 403(b), and ...

What are the 403b Rollover Rules? | IRA vs 401k Central Jun 22, 2014 · Non-profit employers and public education organizations often offer their employees 403b retirement savings accounts, which allow them to make pre-tax contributions with every paycheck to fund their retirement. 403b accounts are very similar to 401k plans that are offered to employees of larger for-profit and private companies. If you have a 403b plan and …

403b vs 401k Plans: What's Better For Retirement ... Another key difference is that 403b plans tend to have lower expense ratios, since they are subject to less stringent reporting requirements. This translates into lower fees or management costs for employees. Finally, 401k plans tend to be administered by mutual fund companies.

403(b) vs. 401(k) - What's the Difference? - SmartAsset 403(b) vs. 401(k): Differences. There are some noteworthy differences between a 403(b) vs. a 401(k). The most important is the types of companies that offer the two plans. For-profit companies offer 401(k) plans. Most people work at for-profit companies, meaning the majority of retirement plan participants use a 401(k.) Not-for-profit and ...

403(b) Plan: How it Works and Pros & Cons - The Motley Fool A 403 (b) plan is a type of retirement account available to individuals who work in public education, employees of certain 501 (c) (3) tax-exempt organizations, and ministers. It's similar to ...

How is a 403(b) different from a 401(k)? - Ultimate Guide ... The main difference is the type of employers who can offer them. Unlike 401 (k) plans which are offered by for-profit companies, 403 (b) plans are only available to employees of tax-exempt ...

PDF COMPARISON OF 401(k) AND 403(b) PLANS In general, the new regulations narrow the difference between 401(k) and 403(b) plans, making 403(b) plans much more like their 401(k) cousins. ERISA vs. non-ERISA plans - 403(b) plans without employer contributions, or those sponsored by governmental employers or churches will not automatically be subject to ERISA. This chart was prepared to ...

What is a 403(b) plan and how does it work? 403(b) vs. 401(k) plans. Like a 401(k), 403(b) plans can be funded with pre-tax or after-tax dollars. Pre-tax contributions grow tax-deferred until you withdraw them at retirement, at which point ...

403(b) Plan vs. 401(k) Plan: What's The Difference ... A 403b, on the other hand, can only be offered by educational institutions and tax-exempt organizations. All employees are eligible to participate, but the employers may limit their participation rules more tightly than with a 401k. This applies to both government employers and non-profits. Contribution Limits

Can I Roll Over a 403(b) to an IRA or Another Account? Apr 24, 2021 · Many people change jobs multiple times over their careers, which can result in a trail of retirement accounts. Consolidating your retirement accounts can make it easier to manage and monitor your progress. When you roll over the assets in your 401(k) or 403(b) account into an IRA (Roth or traditional) or SEP (Simplified Employee Pension), your potential tax advantages …

The Differences Between 401(k) and 403(b) Plans The primary difference between the two is the type of employer sponsoring the plans—401 (k) plans are offered by private, for-profit companies, whereas 403 (b) plans are only available to nonprofit...

0 Response to "42 403b vs 401k"

Post a Comment